eToro review 2024: The pros and cons are explained by Digimagg

Discover our comprehensive review of eToro in 2024, exploring its user-friendly interface, trading opportunities, and suitability for traders.

Our Verdict

Our Verdict

eToro is a prominent online trading platform that has garnered attention for its unique approach to social trading and diverse investment offerings. Established in 2007, eToro has since evolved into a major player in the financial technology sector, providing users with a user-friendly interface and a wide array of trading instruments. eToro's standout feature is its emphasis on social trading, which enables users to follow and copy the trades of other investors in real-time. This social aspect adds a layer of community engagement and knowledge-sharing to the platform, making it particularly appealing to novice traders looking to learn from more experienced investors.

Pros

Pros

- Regulated and secure

- User-friendly interface

- Diverse investment options

Cons

Cons

- Customer support

- Leverage restrictions

- Limited cryptocurrency availability

Starting price

$7.37Withdrawal fee

$5 ($30 minimum withdrawal requirement)Incoming wire (domestic)

$8.00What is eToro?

eToro is an internet-based brokerage platform providing trading services for various assets including stocks, cryptocurrencies, ETFs, indices, commodities, and options. In 2013, it expanded its offerings to include commodities and cryptocurrencies, starting with Bitcoin and later adding numerous other digital currencies.

With its headquarters situated in Israel, eToro has expanded its presence globally, establishing offices in the US, the UK, Australia, and Cyprus.

The origins of eToro trace back to 2007 when brothers Yoni Assia and Ronen Assia, along with David Ring, founded the company initially named RetailFX. Presently, the platform has amassed a user base exceeding 33 million worldwide, gaining significant recognition particularly in the US and UK.

Setting itself apart from competitors, eToro introduces a distinctive feature for investors: the ability to replicate the trading strategies of other cryptocurrency traders through a feature called eToro copy trading.

eToro's Popular Investor program offers extra financial incentives to proficient cryptocurrency traders who attract a following. Followers can capitalize on successful trades without requiring extensive investment expertise. However, the availability of this feature varies depending on the market. In the UK, copy trading is accessible for all assets, whereas in the US, it's restricted to cryptocurrency trades.

Additionally, there's a social news feed where traders can exchange insights on market dynamics and trends, fostering a sense of community not commonly found on other trading platforms.

What assets are available for trading and investment on eToro?

Frequently, exchanges and brokerages limit their offerings to just a few asset types. However, eToro stands out by providing investors access to multiple asset classes through a single trading account. Depending on your location, you may have access to the full range of assets offered by eToro. However, in certain regions like the US, you may not be able to trade forex (foreign currencies) and commodities such as oil, gold, or silver.

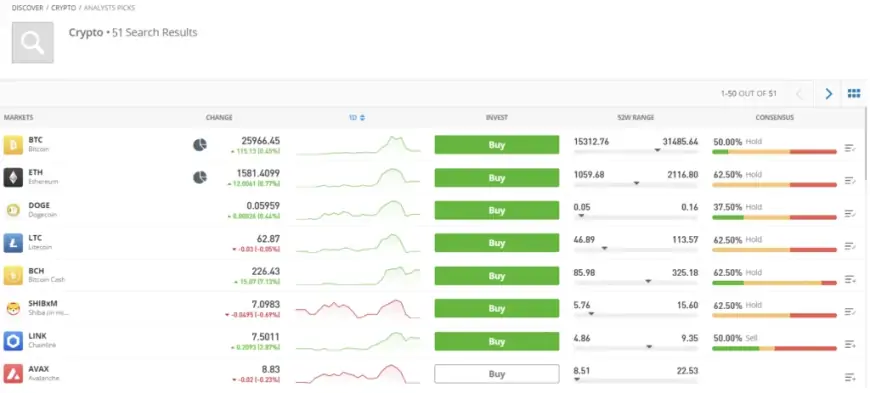

Cryptocurrencies

eToro provides trading options for approximately 80 cryptocurrencies, though certain assets may not be accessible in specific regions. In the US, trading is offered for 23 cryptocurrencies, including Bitcoin. The platform offers widespread availability for major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), which collectively represent nearly 70% of the global cryptocurrency market capitalization.

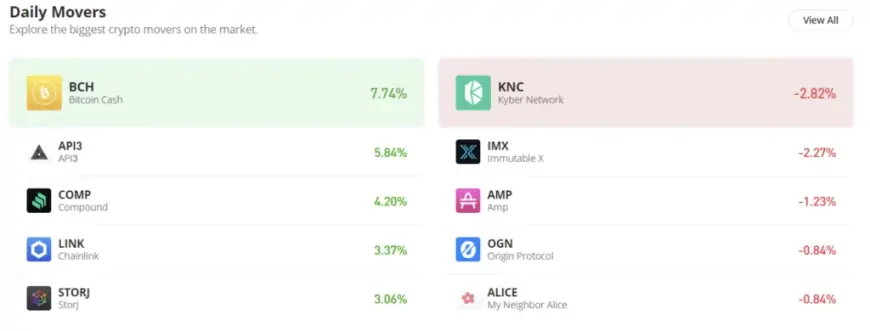

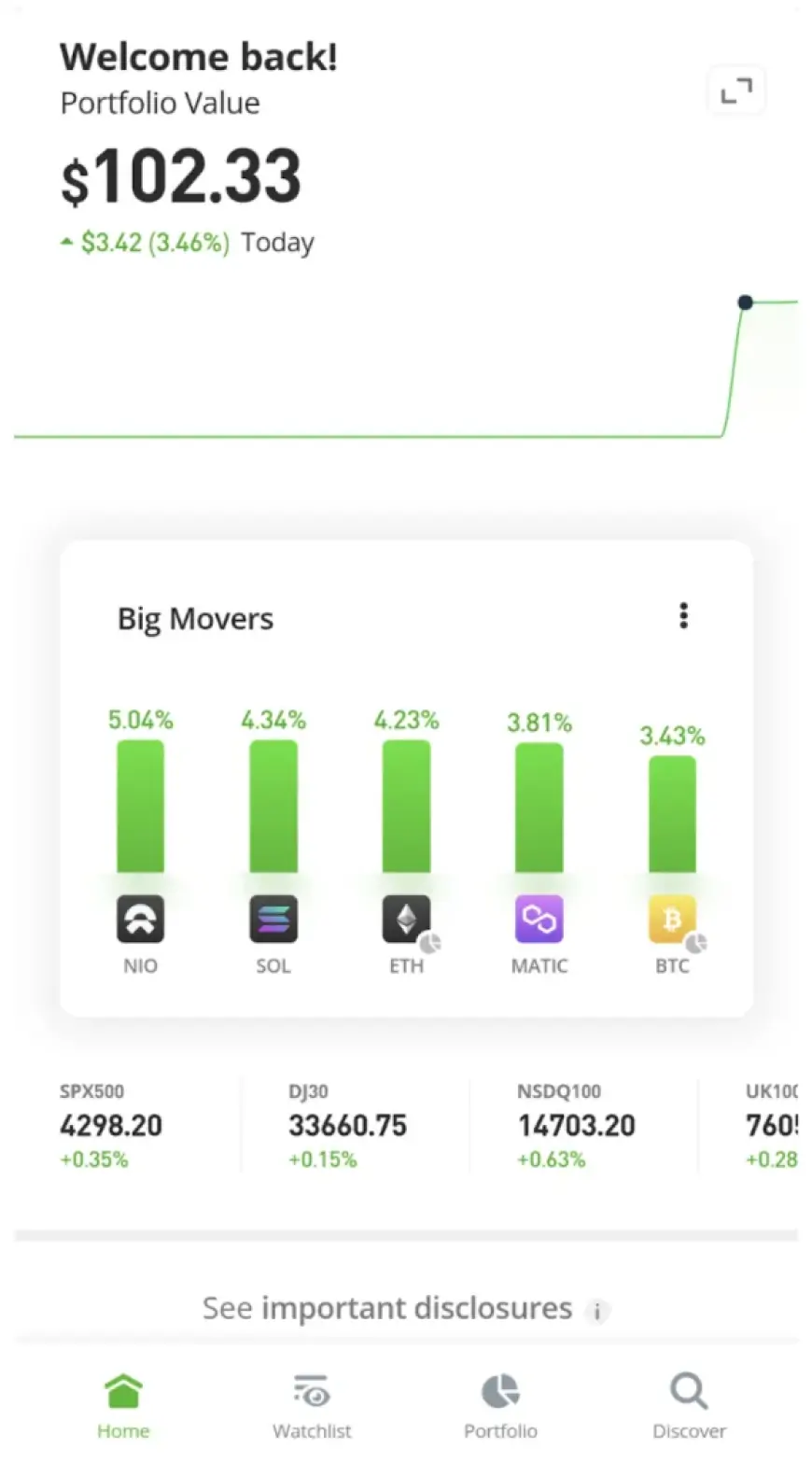

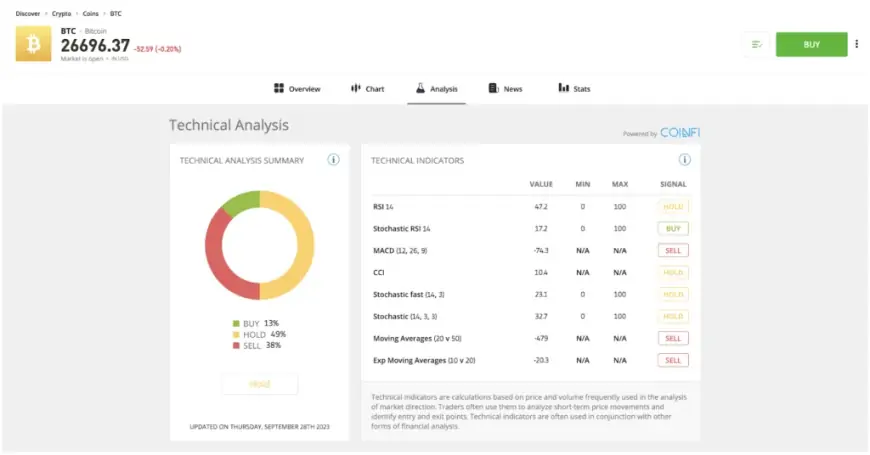

The "Discover" section on eToro presents a summary of the daily market movers and shakers. By clicking on a cryptocurrency that interests you, you can access additional information, including detailed charts, technical analysis, specific news related to the asset, statistics, and even trading indicators.

Crypto staking

Here's the process:

Staking involves using cryptocurrency as collateral to validate transactions on the blockchain. When validators successfully add a block, proof-of-stake networks reward them with staking rewards. These rewards typically yield around 3% to 5% APY, sometimes even higher, and are usually paid in additional (staked) crypto.

However, manually staking crypto can be overwhelming. Platforms like eToro can handle the technical aspects of staking for you. The crypto staking platform, such as eToro, receives the rewards and retains a portion, passing on the rest.

Rewards vary based on customer tier, known as "clubs"

- Diamond, Platinum+ Club members retain 90% of staking rewards.

- Silver, Gold, and Platinum Club members retain 85%.

- Bronze Club customers retain 75% of staking rewards.

Equities

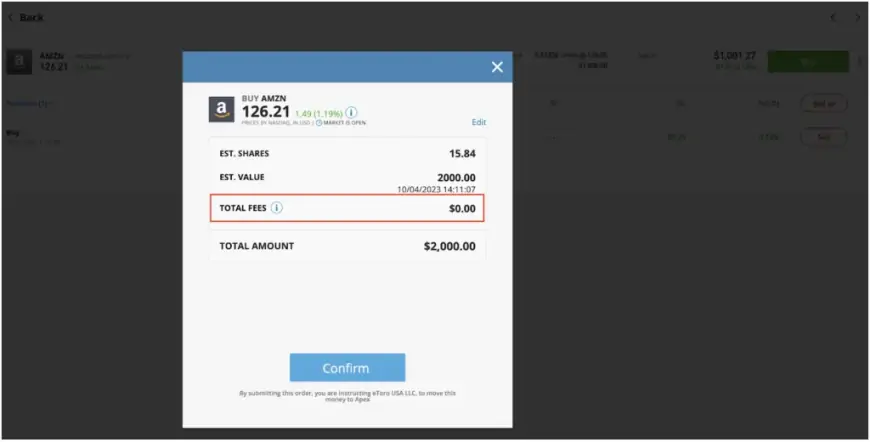

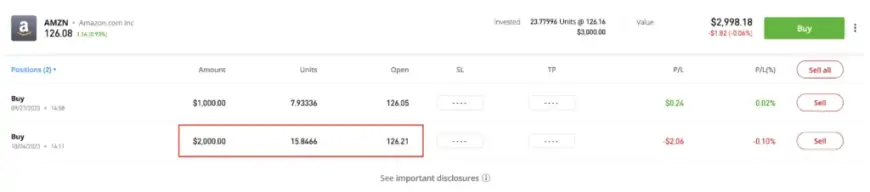

eToro also provides the option for fractional stock purchases. With eToro's stock trading platform, you're not required to invest $400 or more in a single share of Nvidia. Instead, you can purchase a portion of a share, even as little as one and a half shares, depending on your investment preference. With a minimum deposit of $10, eToro allows investors to buy fractional shares of stocks valued above this minimum investment.

Currently, eToro offers a selection of over 4,000 stocks including major names such as AAPL, TSLA, and AMZN, among others. This range of offerings stands out favorably against other brokers, particularly CFD brokers, many of which offer only about one-third of this selection.

Stock CFDs

Contracts for Difference (CFDs) are trading agreements where you're not purchasing the actual asset itself. Instead, you're trading contracts based on the anticipated future price of the asset. This setup enables trading in both directions: you can take a short position if you anticipate the price will decrease, or a long position if you anticipate the price will rise. In eligible markets like the UK, you have the option to trade either stocks or stock CFDs.

Equity options

As implied by its name, an option grants you the right to purchase or sell shares at a predetermined price on a future date. At this stage, you're not directly engaging in the buying or selling of the stock. Instead, you're acquiring a contract that provides you with the opportunity to execute the transaction at the specified price.

- Buying options are commonly referred to as call options or "calls."

- Selling options are known as "puts."

eToro is upfront about the risks associated with options trading, specifically highlighting the potential loss of the entire investment in purchased options.

Options trading on eToro may be a sensible approach for certain investments. However, given the elevated level of risk involved, options are most suitable for experienced traders.

ETFs (Exchange-Traded Funds)

Choose from a selection of over 400 ETFs available on eToro. ETFs, also known as exchange-traded funds, offer a convenient option to invest in a single asset that mirrors an index, a sector, or an individual asset like gold.

The availability of eToro's ETFs varies depending on your region. Here are some popular options you can trade on eToro:

- Invesco QQQ (QQQ): Easily track the performance of the Nasdaq 100 index with this ETF.

- SPDR S&P 500 ETF (SPY): This renowned ETF tracks the companies listed on the S&P 500, including prominent names like Alphabet (Google), Tesla, Amazon, Nike, and more.

- iShares 20+ Year Treasury Bond ETF (TLT): The TLT ETF invests in long-term US government bonds, providing traders with a means to diversify their portfolio without the complexities of individual bond purchases.

- Vanguard Total Stock Market ETF (VTI): For those who find it challenging to decide where to invest, VTI offers exposure to a broad range of stocks. This fund holds approximately 4,000 individual stocks, spanning from microcap to the largest companies globally.

- SPDR Gold ETF (GLD): Investing in physical gold entails storage concerns. The GLD ETF offers exposure to the gold market without the hassle of physical storage.

Indices

eToro also provides index trading through a product known as CFDs (Contracts for Difference). CFDs can be viewed as derivatives, allowing traders to use leverage and trade indices round the clock, unlike ETFs, which are limited to market hours.

With indices offering leverage trading, traders have the option to go short if they anticipate a market downturn, a capability not available with ETFs unless an inverse ETF for the specific index is found.

Some popular index choices include:

- USDOLLAR: Monitor the US dollar's value against a selection of international currencies such as the UK Pound, Euro, Canadian Dollar, Swiss Franc, Japanese Yen, and Swedish Kroner.

- NASDAQ100: Speculate on the price movement of the top 100 stocks listed on the Nasdaq.

- DJ30: Tracking the fluctuations of the Dow Jones Industrial Average, composed of 30 leading blue-chip stocks like Apple, Intel, JPMorgan Chase, and General Electric.

- SPX500: This index mirrors the performance of the S&P 500, comprising the 500 largest companies traded on US stock exchanges.

- UK100: Representing the FTSE 100, or "Footsie," index, which consists of the top 100 companies on the London Stock Exchange by market capitalization.

Indices enable traders to engage in worldwide markets, both long and short, utilizing leverage. While leverage trading offers the potential for increased profits, it also magnifies potential losses.

Forex

Foreign exchange (forex) trading involves the exchange of currencies. While daily fluctuations in currency values may appear insignificant at first glance, the use of leverage can magnify these movements significantly. With a daily trading volume surpassing $5 trillion, the forex market stands as the largest market globally.

If you possess adept technical trading skills and a deep understanding of how central bank policies and economic cycles influence currency values, eToro's forex trading platform might be suitable for you.

In forex trading, you simultaneously take two positions in a trade, buying one currency while selling another within a trading pair. While the risks are substantial, the potential for profit can far exceed that of traditional investing.

As one of the premier high-leverage brokers, eToro facilitates forex trading with leverage of up to 30x on major trading pairs like EUR/USD and GBP/USD, and up to 20x leverage on minor trading pairs.

Commodity trading

Commodities trading provides an opportunity to profit from the trade of essential raw materials crucial for modern life. However, instead of trading the physical commodities themselves, you trade contracts.

We're all familiar with the impact of oil prices at the gas pump and wheat prices at the grocery store. Take advantage of this by capitalizing on higher oil prices or speculate on the prices of gold, wheat, soybeans, cotton, and more.

eToro offers trading in over 30 commodities utilized worldwide. Similar to indices, commodities trading on eToro involves the use of CFDs (Contracts for Difference), allowing you to trade or incorporate exposure to commodities into your portfolio without the need to physically possess, for example, 100 barrels of crude oil.

On eToro, you can trade:

- Livestock

- Metals

- Energy

- Soft commodities (like cotton or cocoa)

- Agricultural

Commodity prices are often influenced by distinct market dynamics compared to stocks and bonds, providing an opportunity for profit even when equity markets are stagnant or declining.

Once more, CFDs involve leverage, which means trading with borrowed funds carrying its own expenses and risks. Minor market fluctuations can result in significant gains or losses. Trade cautiously.

Several of eToro's investment options utilize CFDs, which operate similarly to futures contracts or perpetual futures in crypto.

With a CFD, you're entering into a contract that speculates on the future price of an asset without needing to physically possess the asset. The pricing of the contract is maintained close to the market price by implementing a funding rate (or overnight fee) to either encourage or discourage excessive trading activity on one side of the trade.

Due to the high leverage and fluctuating overnight fees, CFDs carry a heightened level of risk compared to conventional trades. It's important to carefully weigh your options before opting for a CFD. For instance, there might be an ETF available that mirrors the performance of an indices CFD trade but with lower risk.

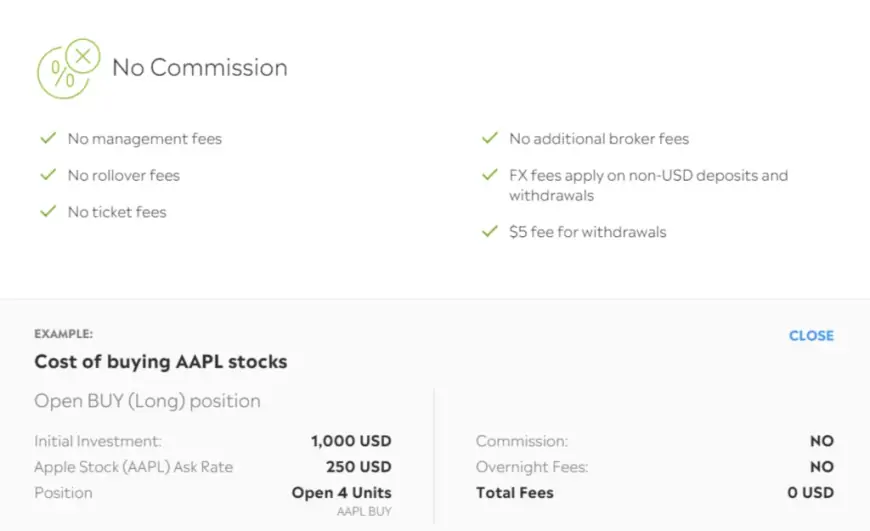

In general, eToro's trading costs for stocks, ETFs, forex, and commodities are competitive with those of similar platforms. For instance, the spread for trading EUR/USD on eToro's forex trading platform is merely 1 Pip (1/100th of 1%), while it stands at 0.15% for stock CFDs.

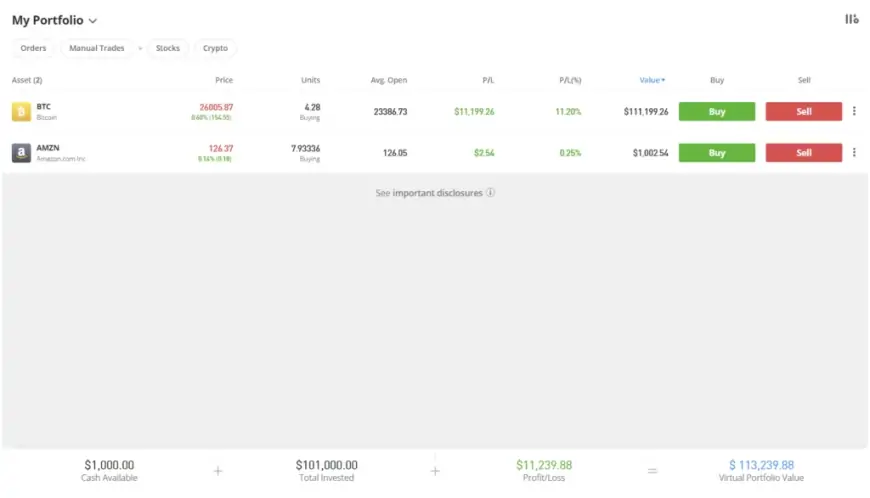

Review of eToro: Social and copy trading features

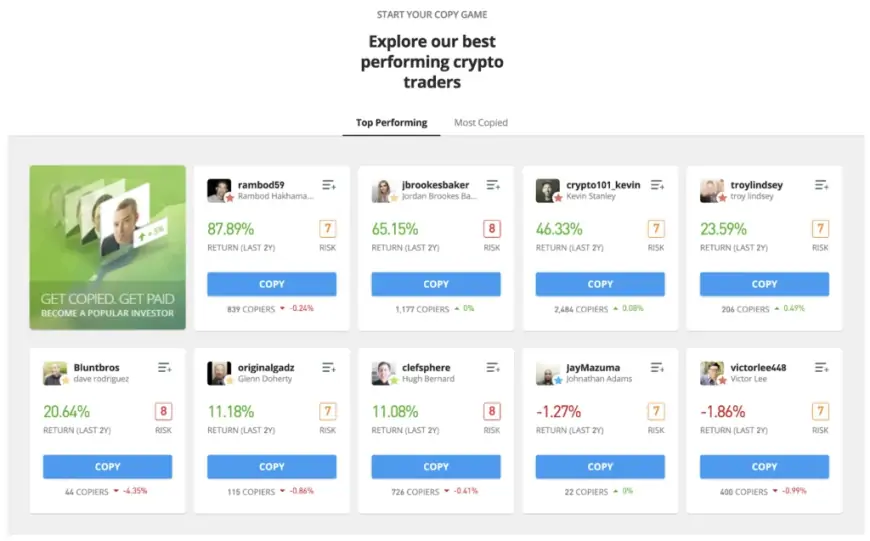

eToro presents a diverse range of investment options, but its social dimension significantly enhances its capabilities. Users can monitor others by adding them to their watchlist or receiving notifications of new posts. Moreover, eToro offers copy trading functionality, a feature that sets it apart as only a handful of platforms provide it. Copy trading enables users to automatically replicate the portfolios and trading strategies of successful investors, making it particularly appealing to beginners lacking the technical or fundamental analysis skills of seasoned investors.

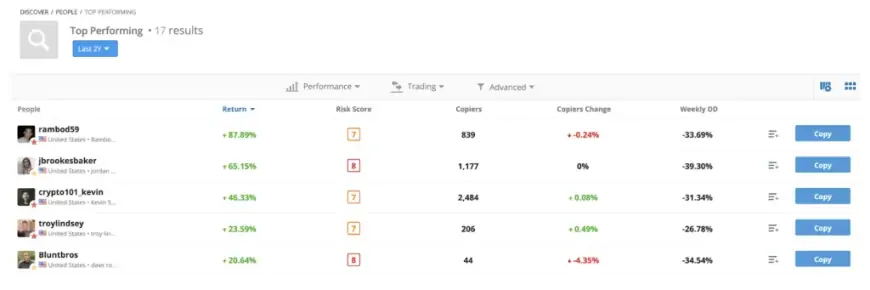

eToro enables users to filter the list of traders based on various criteria such as performance, risk score, and number of copiers. If you're hesitant about the concept, you can replicate a trader's actions in your virtual account, essentially a demo account offering $100,000 in virtual funds for strategy testing—a feature akin to eToro paper trading.

While some eToro traders exhibit impressive statistics, regional restrictions may limit your ability to copy traders from different countries. For instance, in the US, you can only copy trades from other US-based traders. Consequently, if a potential top-performer resides in another country, you won't be able to replicate their trades.

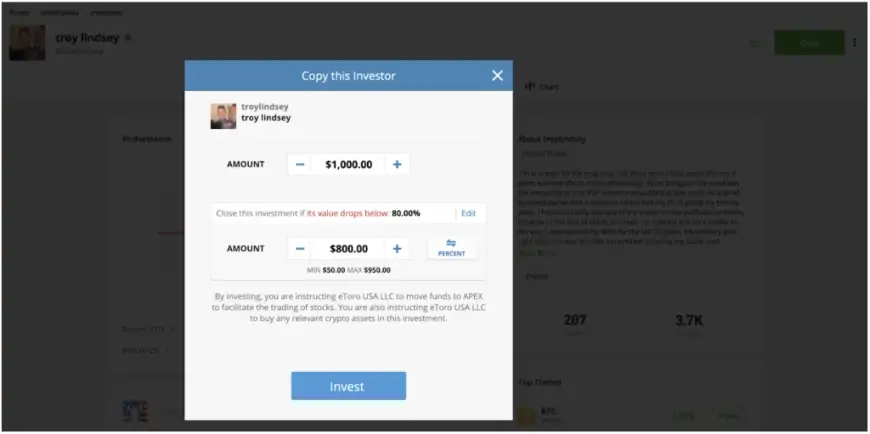

To replicate a trader's moves, you must invest a minimum of $200 per trade. Once you follow them, their trades will reflect in your account, adjusted according to your investment amount. Additionally, you can establish a threshold to halt copying trades, indicating the maximum risk you're willing to take before ceasing to imitate a specific trader.

For instance, in the given scenario, we've designated a "stop loss" at 80% of the initial investment.

Key points of copy trading traders

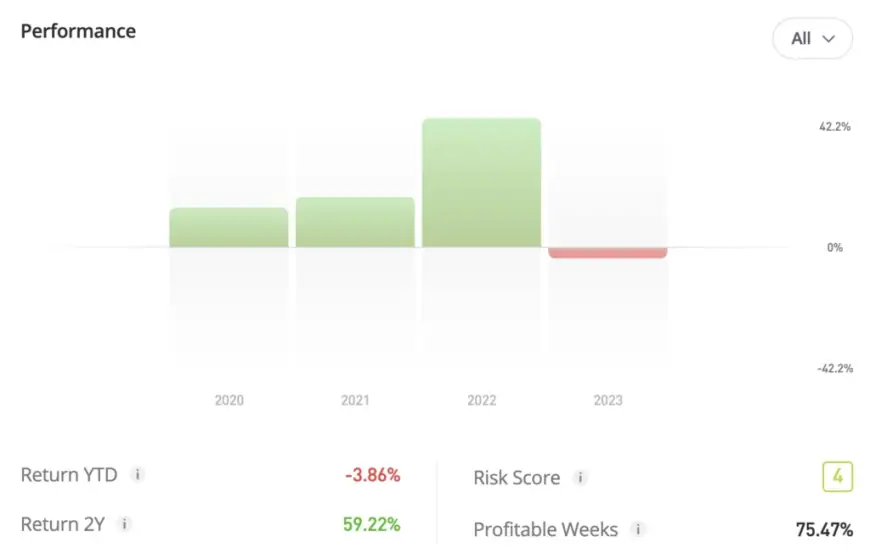

Here are some noteworthy highlights based on 2-year performance.

Please note that Copy Trading does not constitute investment advice. The value of your investments may fluctuate, and there is a risk to your capital.

- rambod59: Rambod Hakhamaneshi's performance indicates the validity of the adage that one only needs to be right 51% of the time to profit. With 50.88% profitable trading weeks and a nearly 88% 2-year return, Rambod focuses on a core portfolio of BTC, ETH, and COMP, yielding a six-month performance of just under 13%.

- jeppekirkbonde: With a low risk rating of just 4, Jeppe has achieved nearly 53% profitable weeks and reports a 25% annual return since 2013. Notable assets include NVDA with a 294% return and RHM.DE with over 173% return.

- edwhite1 With a 2-year return of over 84%, Edward Anthony Martin White's trading warrants attention. Ed demonstrates adept timing and solid choices, evident in profitable trades like NVDA (1,128%), AAPL (487%), and MSFT (390%).

- troylinsey Troy Lindsey adopts a dip-buying approach for long-term crypto investments, emphasizing concepts like dollar-cost averaging (DCA). With a year-to-date performance exceeding 50% and a broad portfolio of 17 crypto assets, Troy focuses on strategic, long-term gains.

- bluntbros: Dave Rodriguez showcases a 33.45% year-to-date return and over 20% 2-year return, blending blue-chip assets like BTC, ETH, and LINK with meme coins such as DOGE and SHIBxM (SHIB). Dave relies on technical analysis and buys during market dips.

- crypto101_kevin: Kevin Stanley, associated with the Crypto 101 podcast team, boasts an impressive 52.47% year-to-date return and over 46% 2-year returns. Kevin maintains a diversified portfolio, including BTC, ETH, LTC, and DeFi blue-chip altcoins like MKR, AAVE, UNI, and COMP.

- jbrooksbaker Jordan Brooks Baker primarily acquires ETH on eToro, viewing it as "digital real estate" for long-term gains. With year-to-date returns surpassing 30% and 2-year returns over 65%, Jordan emphasizes long-term strategies over frequent trading.

How do you go about choosing which traders to copy?

Take into account the risk score provided by eToro, and then examine the historical trades of traders you're contemplating for copy trading.

Review trader profiles to gain insight into their trading strategies. Individuals who closely follow the cryptocurrency market, for instance, might possess a better understanding of which emerging tokens are worth investing in and when market fluctuations are exaggerated. Similarly, someone with a background in real estate could offer valuable insights into the future prospects of homebuilder stocks, home improvement retailers, as well as home lenders and insurers.

With a vast user base exceeding 33 million, this premier copy trading platform boasts knowledgeable traders across various market sectors. Prior to copying their trades, you can assess their track record to inform your decision.

Additionally, consider the frequency of trades. Each transaction involving crypto assets incurs a 1% fee, so minimizing trade frequency may lead to higher returns. This is particularly relevant for assets with wider spreads, as spreads contribute to your trading expenses. Furthermore, reducing trade frequency could result in tax savings, especially when considering the disparity between long-term and short-term capital gains rates.

eToro copy portfolios (Smart portfolios)

Copy trading can resemble Forrest Gump's box of chocolates: unpredictable. The trader you're mirroring might execute unexpected moves that don't align with your preferences.

If you seek a hands-off investment approach with a more focused strategy and minimal surprises, you might consider eToro's Smart Portfolios, formerly known as CopyPortfolios. These portfolios cover a wide range of niches or sectors, such as cryptocurrencies, stocks, and ETFs.

To begin investing in smart portfolios, a minimum of $500 is required. These portfolios are meticulously curated by eToro analysts, aiming to provide diversification while targeting specific sectors or investment objectives.

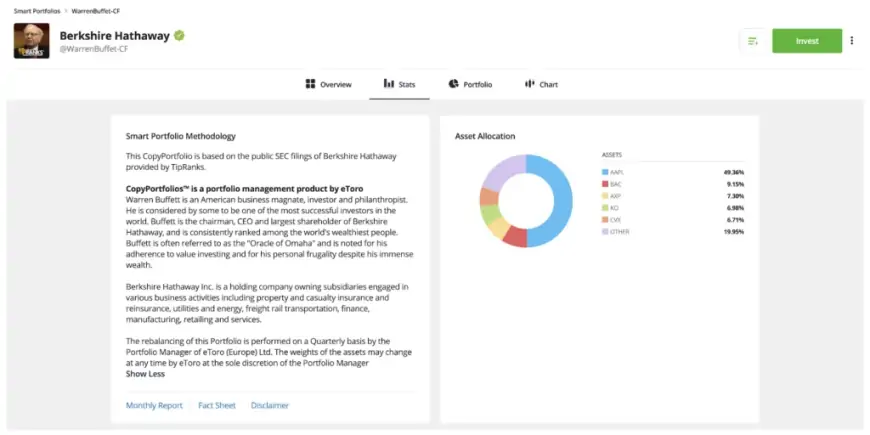

Some smart portfolios replicate the investments of renowned funds, like the CopyPortfolio tracking the SEC-reported trades of Warren Buffett's Berkshire Hathaway.

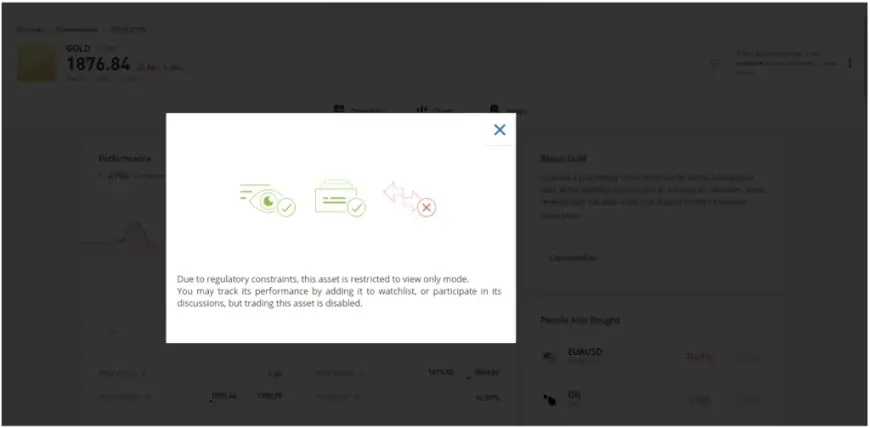

The availability of smart portfolios varies depending on location. For instance, the Berkshire Hathaway smart portfolio isn't tradable in the US due to regulatory constraints, although crypto smart portfolios remain accessible. Notably, the Berkshire Hathaway portfolio demonstrates a 2-year return exceeding 16%. Meanwhile, the Coinshares France SAS smart portfolio boasts an impressive 148% 2-year return, employing machine learning strategies to invest in cryptocurrencies.

eToro trading platforms

eToro utilizes its own proprietary platform, meaning it doesn't offer support for APIs, which are add-ons used to access the platform's backend rather than its user interface. Additionally, eToro doesn't support MetaTrader 4 (MT4), MetaTrader 5, or other third-party platforms commonly associated with forex trading. Essentially, eToro prioritizes user-friendly design and simplicity in its platform.

Review of eToro: User interface and experience

Anticipate a user-friendly journey as you explore eToro's platform tailored for beginners. Most essential trading features are conveniently accessible within a click or two from the main menu. Moreover, you have the flexibility to personalize your start page, whether it's displaying your portfolio or social feed, thus making eToro uniquely yours.

However, some aspects of the app may feel disconnected. For instance, if you wish to trade options, you'll need to utilize the mobile app. Additionally, transferring cryptocurrency to an external wallet involves more steps than ideal. Initially, you must transfer the funds to eToro Money, another mobile app, before transferring them to another crypto wallet.

These additional steps constitute our primary reservations about the eToro platform. Overall, the experience could benefit from more seamless integration. Nevertheless, for most traders, this might not pose a significant concern. If your primary objective with eToro is to engage in buy-and-hold strategies or execute basic trades, both the web and mobile apps are likely to offer an intuitive experience and provide all necessary tools for making informed trading decisions.

eToro mobile app

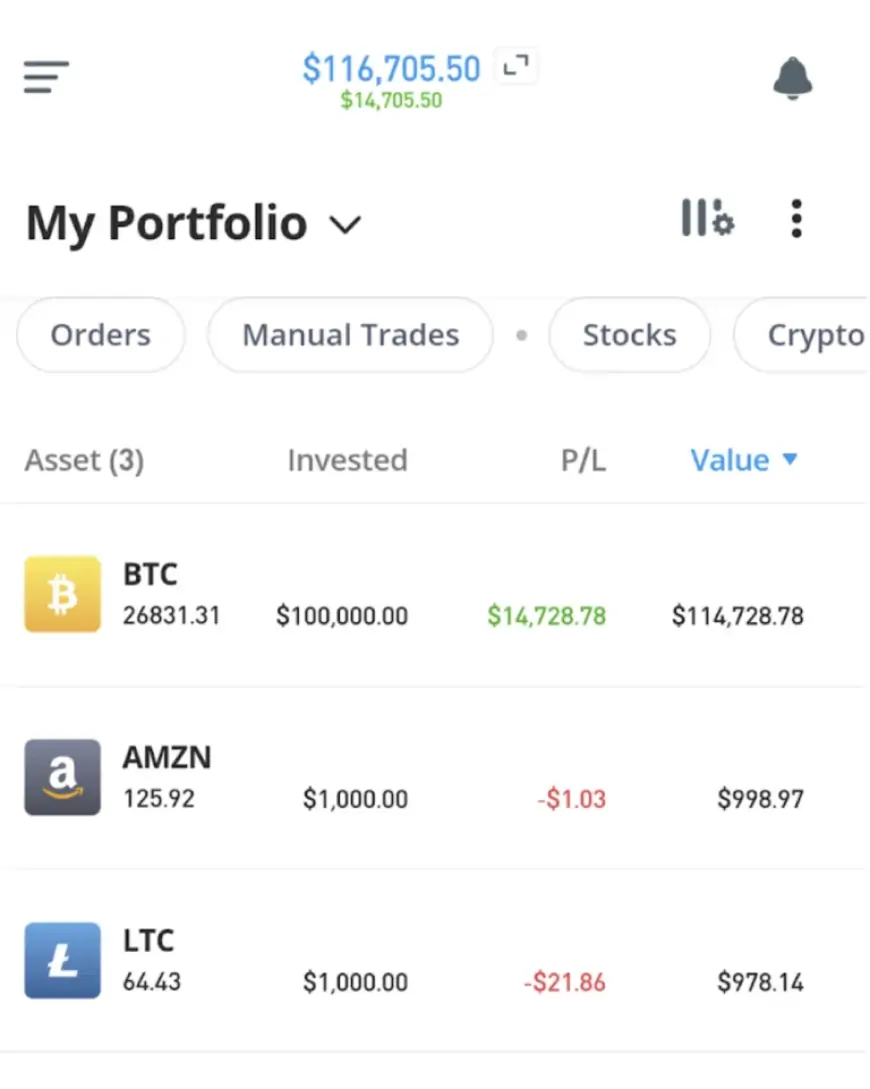

The mobile app of eToro provides a clearer understanding of its core concept: social investing. Upon logging in, you're welcomed with a summary detailing your portfolio's daily performance.

As you scroll down, you'll encounter a news feed reminiscent of platforms like Twitter or similar apps.

eToro's mobile app offers a swift experience, mirroring the functionality of the desktop app, with one significant addition: alerts. You have the option to set up alerts for assets in your watchlist to ensure you don't overlook any trading opportunities. It's no surprise that it has been recognized as the top forex trading app in 2024.

Furthermore, the virtual account is accessible for practice trading on mobile or for testing out trading strategies while on the move. Expect a user-friendly experience tailored for beginners that doesn't compromise on features on mobile devices.

Review of eToro: Charting and analytical tools

eToro's charting tools typically load a candlestick chart by default, with the option to select from eight other chart types. These charts can be further customized according to your preferences. For instance, you can overlay ETH onto the BTC chart to compare the performance of the top two cryptocurrencies.

The standard charts on eToro are powered by TradingView, offering advanced capabilities once indicators are added. While competitors like Robinhood also provide advanced charts, Robinhood's default setting is a basic chart with only a limited number of trading indicators available. In contrast, eToro offers over 100 indicators on its TradingView charts.

Upon reaching $5,000 in equity (achieving silver eToro Club membership), users gain access to eToro ProCharts. However, even as a bronze member, you can try out this feature for 30 days. ProCharts automatically display users or tradable assets from your watchlist and save your custom layouts. These charts are specifically designed with speed and the needs of active traders in mind.

Select from numerous indicators to incorporate into your chart. Alternatively, eToro provides a pre-compiled summary of prominent buy/sell indicators for quick reference.

Types of eToro accounts

Select from 4 account options when you create an account with eToro.

Methods of payment accepted by eToro

On eToro, various deposit methods are available, with most not incurring deposit fees. However, wire transfers do carry a fee ($8.00 for domestic incoming wires). Additionally, since eToro utilizes USD as its primary currency for deposits, there may be conversion fees for deposits made in other currencies. Payment options differ based on your location, but you can anticipate extensive support for bank transfers and debit cards in major markets.

- Bank transfer

eToro withdrawal times

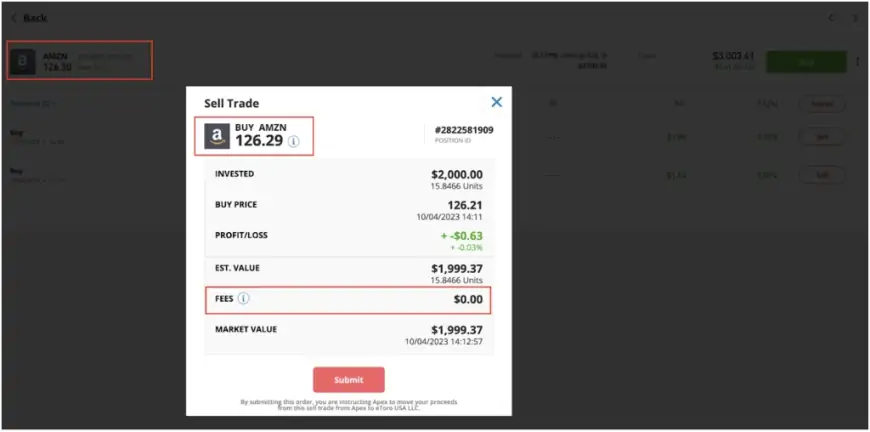

As previously mentioned, eToro imposes a withdrawal fee of $5, with a minimum withdrawal amount of $30. The following table can be useful for anticipating the availability of your funds.

When depositing via bank transfer, eToro imposes a seven-day hold on deposited funds before withdrawal is permitted. Generally, withdrawals must be directed to the same funding source used for the deposit, while trading profits may be returned via ACH bank transfer. If you have earned profits, your withdrawal may be divided between two funding sources.

Expect a brief waiting period before withdrawn funds from eToro become available.

| Withdrawal funding type | Withdrawal time |

| Debit card | Up to 4 business days |

| ACH bank transfer | 2 business days |

| Wire transfer | Up to 7 business days |

| Crypto transfer to eToro wallet (eToro Money) | Up to 5 business days |

| eToro Options (ACH bank transfer) | One to 3 business days |

eToro Demo account

One standout feature of eToro is its demo account, referred to as a "Virtual Portfolio." Standard accounts are allocated $100,000 in virtual funds for investing or trading purposes. Whether you wish to experiment with a trading concept you conceived during dinner or simply want to familiarize yourself with eToro's functionalities, such as copy trading, you can do so with a demo account, without any risk of losing actual money.

Over time, you may notice an increase in your virtual trading limits. In our demo account experience, we initially received $100,000 and later obtained an additional $2,000 in virtual funds.

eToro's paper trading through a demo account also enables you to observe the impact of fees on various trade types. Trades function identically to those on the actual platform. Utilize the knowledge gained from your demo account to inform your real trades.

eToro minimum deposit

Minimum deposit requirements differ depending on the region, with a minimal $10 deposit required for eToro users in the US or UK. On the other hand, eToro users in Australia, France, Germany, or Italy are required to deposit a minimum of $50.

eToro customer support

With its user-friendly interface tailored for basic trades, most eToro users are unlikely to require support assistance. However, if you do need to get in touch with eToro, you have three options:

1. Chat: eToro's chat agents are available 24 hours a day, Monday through Friday.

2. WhatsApp: eToro Club members (Silver and above) have access to support via WhatsApp. Additionally, all users with an equity balance of $5,000 or more can utilize WhatsApp support at no extra cost.Ticket System: You can submit a support request through the ticket system. Expect a response by email within 48 hours.

3. Ticket System: You can submit a support request through the ticket system. Expect a response by email within 48 hours.

On Trustpilot, eToro boasts one of the highest ratings in the industry. In comparison, well-known brokers like Charles Schwab and Robinhood currently have Trustpilot scores of under 2. Similarly, popular crypto exchanges such as Binance and Coinbase have Trustpilot scores of 2.1 or lower.

eToro's Trustpilot rating of 4.4 underscores the company's dedication to customer service and its promptness in addressing customer inquiries.

Following market hours, we contacted eToro with a minor question. Our chat agent promptly connected with us, and afterward, we received a survey request regarding the interaction. Kudos to eToro for their responsiveness.

Accepted countries by eToro

Trading on eToro is accessible in numerous countries globally, including the UK, US, Canada, Germany, France, and Australia. However, certain features may be restricted based on local regulations. For instance, users in the US may encounter limitations on indices, commodities, and various types of CFD trading.

eToro also provides a roster of countries where its services are not available due to regulatory constraints or risk assessments. It's worth mentioning that a settlement agreement with the Ontario Securities Commission prohibits eToro trading activities in Canada.

Safety and security: Licensing and protection measures at eToro

Governmental approaches to consumer protection typically involve licensing requirements, which bring brokerages, money transmitters, and exchanges under the oversight of local regulatory authorities. This entails additional reporting obligations for brokerages and heightened supervision by regulators.

eToro stands out as one of the few crypto exchanges regulated by licensed bodies such as CySEC in Europe, offering trading services in over 100 countries globally.

In general, licensing and regulatory oversight contribute to safer trading environments for investors, despite variations in the types of trades permitted by governments worldwide. Regulators scrutinizing disclosures and filings enhance transparency and compliance, thereby reducing the risk of losses for retail investors.

In major markets outside the crypto sphere, eToro holds licenses with local regulators:

- Europe: eToro falls under CySEC regulation across Europe.

- UK: eToro is registered with the Financial Conduct Authority (FCA) in the UK. Europe: eToro falls under CySEC regulation across Europe.

- USA: eToro is registered with FinCEN in the US, along with holding money-transmitter licenses in most US states. Additionally, the brokerage is registered with the Securities and Exchange Commission (SEC).

- Australia: The Australian Securities & Investments Commission (ASIC) regulates eToro in Australia.

Licensing and regulatory oversight offer consumers an additional layer of vigilance, with governmental agencies sometimes providing financial assurances in certain jurisdictions. In the US, cash deposits are insured through the FDIC, while securities (stocks, ETFs, and options) are insured through the SIPC, up to applicable limits for each account. However, cryptocurrencies are not insured.

In terms of account security, eToro implements fundamental protections that traders anticipate, including SSL encryption and two-factor authentication for logins.

In summary, eToro's intuitive interface caters well to both novice and intermediate traders, while still accommodating advanced traders.

Trading opportunities are contingent upon geographical location and regulatory frameworks. For instance, numerous trading options on eToro are unavailable in the US due to regulatory restrictions. Nonetheless, eToro offers appealing features regardless of location. These include transparent fee structures, customizable charts, purchasing indicators, copy trading, and a demo account for learning trading fundamentals or testing strategies without risk.

In this assessment of eToro, we find the platform to be suitable for most traders, particularly those who value the convenience of copy trading and smart portfolios for hands-off trading.