Best penny stock trading apps: A guide to investing

Discover top penny stock trading apps for quick, low-cost investments and real-time market updates.

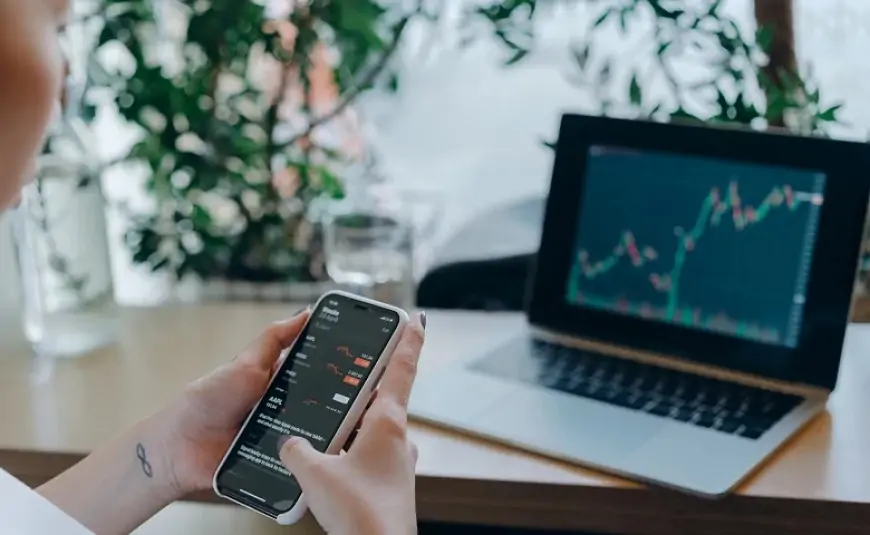

Penny stocks are gaining popularity due to their low cost and potential for high returns. However, they come with significant risks due to their volatility. Using a penny stock trading app with real-time data and analysis can help mitigate these risks by identifying stocks with strong potential.

A reliable penny stock trading app allows you to monitor stocks conveniently on your smartphone, offering streaming data, real-time alerts, thorough analysis, and swift trade execution. Not all apps are equal, though, and choosing one with these features is crucial for success. Our roundup highlights the top penny stock trading apps across six categories to assist you in finding the right fit for your investment needs.

Best penny stock trading apps

Read Digimagg's Review

Charles Schwab is a prominent American financial services company that offers a wide range of investment and banking services. Founded in 1971 by Charles R. Schwab, the company has grown to become one of the largest and most trusted names in the brokerage industry. Schwab provides an array of financial products and services, including individual retirement accounts (IRAs), investment advisory services, trading platforms, and comprehensive financial planning

One of Schwab's key features is its user-friendly online trading platform, which allows investors to trade stocks, bonds, ETFs, mutual funds, and more. The company was a pioneer in reducing trading commissions, and in 2019, it eliminated commissions for online stock, ETF, and options trades, setting a new industry standard.

Commission-free trading

Commission-free trading Comprehensive investment options

Comprehensive investment options Extensive Educational resources

Extensive Educational resources.png) Fees for some services

Fees for some services.png) Platform complexity

Platform complexity.png) Interest rates on cash holdings

Interest rates on cash holdings

Read Digimagg's Review

TradeStation is a well-regarded brokerage firm known for its powerful trading technology and comprehensive platform designed to cater to active traders and sophisticated investors. Founded in 1982, TradeStation has established itself as a leader in the online brokerage industry, particularly for those who engage in frequent trading and require advanced tools for analysis and execution.

TradeStation's platform is highly acclaimed for its robustness and versatility. It offers extensive charting capabilities, customizable interfaces, and a wide range of technical analysis tools. The platform is available as a desktop application, web-based platform, and mobile app, ensuring that traders can access their accounts and trade from anywhere.

Comprehensive asset coverage

Comprehensive asset coverage Commission-free trading

Commission-free trading Powerful trading tools

Powerful trading tools.png) Fees for some services

Fees for some services.png) Minimum account requirements

Minimum account requirements.png) Limited banking services

Limited banking services

Read Digimagg's Review

Fidelity Investments is a renowned multinational financial services corporation that offers a broad range of investment products and services. Founded in 1946 by Edward C. Johnson II, Fidelity has grown to become one of the largest and most respected brokerage firms globally. It provides comprehensive solutions for individual investors, businesses, financial advisors, and institutions.

Fidelity offers a diverse array of investment products, including stocks, bonds, mutual funds, ETFs, options, and more. The firm also provides retirement accounts such as IRAs, 401(k) plans, and 529 college savings plans.

User-friendly platforms

User-friendly platforms Strong customer service

Strong customer service Financial planning services

Financial planning services.png) Platform complexity for advanced tools

Platform complexity for advanced tools.png) Fees for some services

Fees for some services.png) High minimums for managed accounts

High minimums for managed accounts

Read Digimagg's Review

Robinhood is an investment app that offers commission-free trading of stocks, options, and cryptocurrencies. With it, users can invest quickly and easily, even with small amounts of money. One of Robinhood's key advantages is its simple and user-friendly interface, making investing accessible to a wide audience. Additionally, the app provides real-time market updates, helping users make informed decisions.

Commission-free trading

Commission-free trading Fractional shares

Fractional shares Cryptocurrency access

Cryptocurrency access.png) Customer service

Customer service.png) No retirement accounts

No retirement accounts.png) Past regulatory issues

Past regulatory issues

Read Digimagg's Review

E*Trade is a prominent financial services company that offers a comprehensive suite of online brokerage and banking services. Founded in 1982, ETrade was one of the first firms to introduce online trading, and it has since become a major player in the brokerage industry, catering to a diverse range of investors from beginners to active traders.

E*Trade provides access to a wide variety of investment products, including stocks, bonds, mutual funds, ETFs, options, futures, and forex. This extensive selection allows investors to build well-diversified portfolios.

Robust trading platforms

Robust trading platforms Extensive research and education

Extensive research and education Integrated banking services

Integrated banking services.png) Margin rates

Margin rates.png) Fees for some services

Fees for some services.png) Account minimums for managed accounts

Account minimums for managed accounts

Closing thoughts

If you could combine the standout features of the mobile apps mentioned, you'd get the Charles Schwab penny stock trading app. It boasts an intuitive interface, top-tier tools and resources, exceptional research capabilities, and an excellent user experience—all without any trade commissions or account fees.

Schwab's mobile app offers unrestricted trading in penny stocks and provides screening and research tools to help identify promising options and evaluate their risk. While penny stock investment comes with inherent risks, Schwab investors can rely on best-in-class trading and educational resources to make more informed decisions.

Analyze the penny stock trading apps

| Course | Minimum deposit | Fees | Commission Rates | Other Investment Options |

| Charles Schwab | 0$ | None | $0 on all stock trades | Stocks, bonds, funds, ETFs, options, futures |

| Tradestation | 0$ | None | $0 on all stock trades, $0.005 per share over 10,000 shares | Stocks, bonds, ETFs, options, futures, crypto |

| Fidelity | 0$ | None | $0 on all stock trades | Stocks, bonds, ETFs, options, futures |

| Robinhood | 0$ | None | $0 on all stock trades | Stocks, bonds, ETFs, options, crypto |

What are the fees for trading apps when purchasing or selling penny stocks?

Not long ago, most brokers charged commissions or a flat rate for buying and selling penny stocks. Today, you should be able to trade penny stocks at no cost with no account minimums. You just have to look for possible hidden fees or limitations, such as a cap on the number of shares you can trade for free. Plus, if you ever have to use a live broker to execute a trade, you could pay a fee.

Key considerations when choosing a penny stock app

To narrow down your choices for a penny stock app swiftly, begin by comparing costs. Keeping costs low is crucial for maximizing profits and minimizing losses. Many top penny stock brokerage firms offer high-quality apps with zero commissions, so you don't have to compromise quality for affordability.

Additionally, prioritize ease of use. Complex or cumbersome apps can lead to financial losses. A quality penny stock app should feature a user-friendly design and a straightforward process for obtaining quotes and executing trades.

Consider the range of investment options offered by the app. Some penny stock apps limit trading to non-OTC stocks or may impose commissions on OTC trades. Ensure the app provides access to a wide variety of investment opportunities, including stocks, bonds, and ETFs.

Having robust research and analysis tools, or access to them through a desktop platform, is crucial for identifying potential winners and managing risk effectively. Educational resources provided by the app or platform are also highly beneficial.

Is it possible to earn profits with penny stock trading apps?

Certainly, it's possible to generate profits, but the risk of losing money is equally significant. Penny stocks, particularly those priced below five dollars, are deemed high-risk due to the financial instability of the companies or their struggle to establish a market for their products. Additionally, the limited trading volume of penny stocks poses a liquidity risk, especially if you need to sell them quickly.

In essence, investing in penny stocks is speculative in nature. They are characterized by high volatility and unpredictability. Investors in penny stocks should only commit funds they can afford to lose.

.png)