Old Bitcoin miners seize opportunity as cryptocurrency approaches all-time highs

Explore the dynamics of old Bitcoin miners capitalizing on the cryptocurrency's approach to all-time highs. Discover the impacts on Bitcoin's market as early miners cash in.

The recent rapid surge in Bitcoin's price, reaching a new all-time high and then experiencing a quick reversal, has led to early miners selling their old block rewards. On-chain data revealed that approximately 1,000 bitcoins valued at around $69 million were transferred to Coinbase by addresses linked to miners and over a decade old just before Bitcoin's peak and subsequent drop to $62,000 on Tuesday. The movement of long-dormant tokens to Coinbase is seen as a potential precursor to selling.

"Given the exchange order book's indication of 5-10 bitcoins in liquidity for every $100 price change, the sale of 1,000 bitcoins is very likely to initiate a substantial price decline," remarked Bradley Park, an analyst at CryptoQuant, during an interview with CoinDesk. "This effect is particularly pronounced when traders are poised to initiate short positions against Bitcoin's all-time high, as seen on Tuesday."

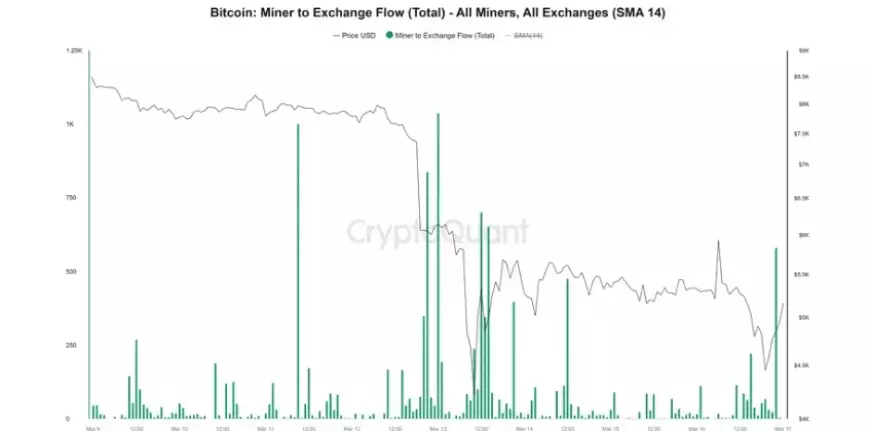

Park noted that the recent surge in bitcoin entering exchanges bears resemblance to the significant increase in BTC inflows observed just before the 40% price decline on March 12, 2020. This drop coincided with the escalating severity of the Covid-19 pandemic, leading to global lockdowns and a flight to safety among traders. Following that sell-off, bitcoin reached its low point at $3,850.