XTB review 2024: Reviewed by Digimagg

Unravel the XTB review for 2024, meticulously explained by Digimagg. Discover its features, usability, and trading process in detail.

Our Verdict

Our Verdict

XTB is a well-established online broker that provides a wide range of trading services, including forex, commodities, indices, stocks, and cryptocurrencies. With a presence in over 13 countries and regulated by several reputable financial authorities, XTB has built a strong reputation in the trading community.

Pros

Pros

- Educational resources

- Customer support

- Regulation and security

- Advanced trading platforms

- Wide range of instruments

Cons

Cons

- Withdrawal fees

- No U.S. clients

- Inactivity fees

- Limited account types

Starting price

$72,22Ark Fintech Innovation

0.44%Interest rate on customer funds

YesWhat is XTB review?

XTB, a widely-used trading platform, facilitates trading across numerous global markets, covering stocks, forex, commodities, indices, and cryptocurrencies.

In this review of XTB, we assess the platform's performance regarding fees, market availability, spreads, payment options, leverage limits, customer support, and other relevant factors.

Which assets does XTB offer?

XTB provides access to a diverse range of financial instruments through CFDs, enabling traders to speculate on stocks, ETFs, cryptocurrencies, indices, and various other assets without needing to own the underlying asset. Additionally, CFDs offer opportunities for leverage and short-selling.

Having outlined the primary advantages and disadvantages, let's proceed with the comprehensive review of XTB. First, we'll delve into the markets supported by XTB.

CFDs

It's crucial to highlight that all instruments supported on XTB operate through contracts-for-differences (CFDs), meaning traders do not possess the underlying asset they trade. Instead, XTB's CFDs track the asset's price. As elaborated in this XTB review, CFDs enable traders to take both long and short positions on their selected markets, with the added advantage of leveraging speculation.

However, it's worth noting that CFD trading is restricted in certain regions, including the US.

Forex

XTB stands out as a premier day trading platform for forex, boasting support for 57 forex pairs encompassing a diverse range of majors, minors, and exotics. Popular pairs like EUR/USD, EUR/GBP, and USD/GBP are readily available. XTB accommodates traders of all budget sizes by allowing trading in micro-lots. Moreover, forex spreads on XTB are highly competitive, with options such as trading EUR/USD starting from just 0.01 pips, while EUR/GBP currently offers a spread of merely 0.18 pips. Forex trading operates round the clock, five days a week. XTB offers generous leverage limits for forex trading, with major pairs allowing leverage of up to 1:500.

This implies that traders are only required to maintain a margin requirement of 0.2%. Put differently, traders can access $500 worth of capital for every $1 invested. Additionally, leverage of up to 1:500 is available for minor pairs like EUR/CAD and EUR/CHF. However, for more exotic pairs such as EUR/MXN, leverage limits are reduced to 1:40.

It's important to note that leverage limits vary depending on the trader's location. For instance, users from the UK, European Union, and Australia are restricted to a maximum leverage of 1:30 for major pairs and 1:20 for minor and exotic pairs.

Indices

Another avenue for accessing stocks on XTB is through indices. XTB supports 30 indices from a variety of international markets. For instance, although individual Australian stocks are not supported, traders can speculate on the ASX200 through XTB. Similarly, XTB offers a range of indices from Asian markets, including India, Japan, and Korea.

In addition to the FTSE 100, XTB also provides support for the S&P 500, Russell 2000, and Dow Jones indices. In comparison to individual stocks, XTB offers significantly higher leverage limits for indices. For instance, major US-listed indices can be traded with leverage of up to 1:200, while more volatile indices like India’s NIFTY 50 allow leverage of 1:33.

Similar to all markets available on XTB, traders have the flexibility to take long or short positions on their chosen indices. Short-selling indices can be advantageous during bearish economic conditions.

Stocks

XTB not only excels as one of the top forex brokers but also boasts a comprehensive stock trading offering. The platform supports nearly 2,000 global stocks across various markets, encompassing over 1,000 stocks from the NYSE and NASDAQ, including prominent companies like Apple, Tesla, Amazon, and Disney.

Furthermore, XTB covers 15 European markets, ranging from the UK, Switzerland, and Portugal to France, Germany, and Norway. However, some traders may find the absence of Asian and South American markets disappointing.

However, leverage is typically available for most supported stocks at a maximum of 1:5. Trading of stocks is limited to standard market hours, with minimum trade requirements varying based on the exchange. For instance, US-listed stocks can be traded starting from $50, whereas UK-listed stocks require a higher minimum of £100.

In comparison, some of the leading stock brokers in the industry offer much lower minimums. For instance, eToro permits traders to buy and sell stocks for as little as $10, regardless of the share price or market.

ETFs

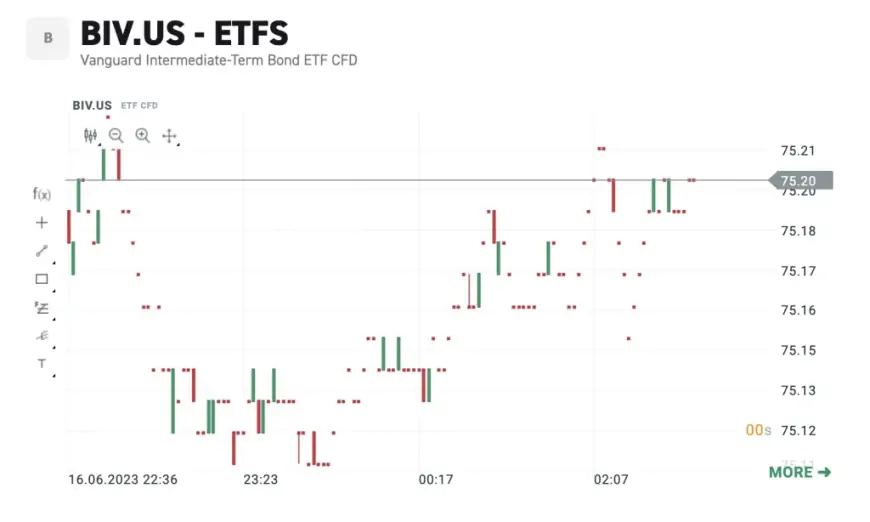

While ETFs are commonly utilized by long-term investors, they can also be traded as CFDs. Our assessment of XTB revealed support for nearly 160 ETFs from various markets. For example, there are several ETFs associated with iShares, including the Automation & Robotics UCITS and MSCI All Country Asia Japan.

Additionally, XTB offers support for the iShares Core US Aggregate Bond ETF, enabling traders to speculate on the future value of US-issued bonds without acquiring ownership. Another popular ETF on XTB is the ARK Fintech Innovation, which provides exposure to a basket of emerging companies and trends such as Coinbase, Block, Shopify, DraftKings, and Robinhood.

On XTB, exposure to commodities can be obtained through CFDs. Notable examples include the Global X Copper Miners and Invesco DB Base Metals Fund. When trading ETFs, the minimum order size is one share. For instance, for the Vanguard Total Bond Market Index Fund ETF, this could amount to slightly over $72 based on current prices.

While leverage is accessible for all supported ETFs on XTB, the limits are considerably lower compared to indices. Typically, most ETFs offer leverage of either 1:2 or 1:5, depending on the market.

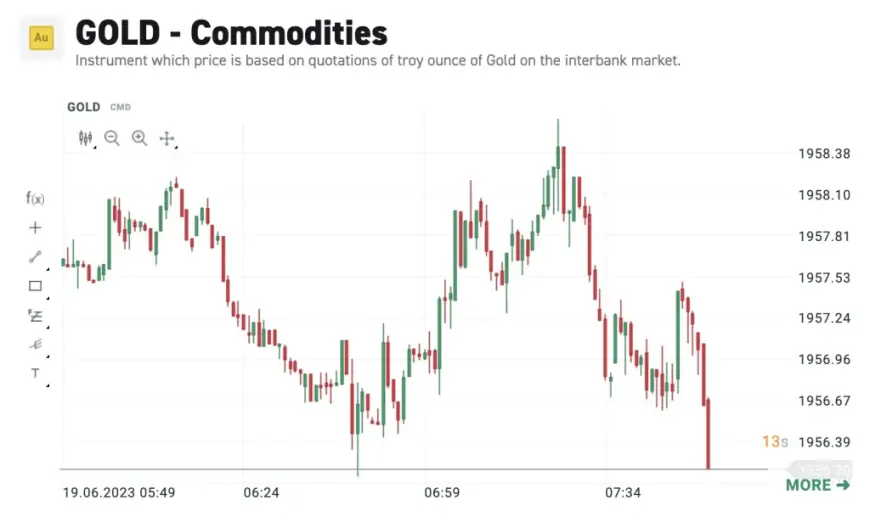

Commodities

Trading commodities through CFDs is among XTB's notable strengths. Unlike futures, there is no requirement to purchase or store the underlying commodity. XTB supports 28 commodities, including various metals such as aluminum, copper, gold, palladium, platinum, silver, and zinc. Additionally, XTB offers coverage for energy commodities like crude oil, WTI oil, and natural gas. Soft commodities such as cotton, corn, wheat, sugar, and soybeans are also tradable on XTB.

Trading hours for commodities vary depending on the underlying market. Additionally, the availability of high leverage levels depends on the specific asset. For instance, gold may be traded with leverage of up to 1:500, while silver is limited to 1:67. However, it's important to note that these limits may not apply to all nationalities.

For example, UK and European traders have leverage limits set at 1:20 for gold and 1:10 for other supported commodities. Another factor to consider is that minimum trade sizes differ across various commodity markets. For instance, traders dealing with cattle CFDs must adhere to a minimum trade size of $400, whereas for gold, the minimum is reduced to $100.

Cryptocurrencies

According to our assessment of XTB, the platform accommodates 48 cryptocurrency pairs. These cryptocurrencies are all linked with the US dollar and are priced based on global spot trading rates. Alongside Bitcoin, XTB offers trading options for various prominent altcoins such as Solana, Stellar, Ethereum, BNB, and EOS.

Trading cryptocurrency CFDs on XTB presents a dual advantage. Firstly, traders have the flexibility to place both buy and sell orders, enabling speculation on price movements in both directions. Secondly, all supported cryptocurrencies can be traded with leverage.

Large-cap cryptocurrencies like Bitcoin and Ethereum come with leverage of 1:5. While lower-cap cryptocurrencies – such as Filecoin and IOTA, can be traded with leverage of 1:2.

What are XTB's fee structures?

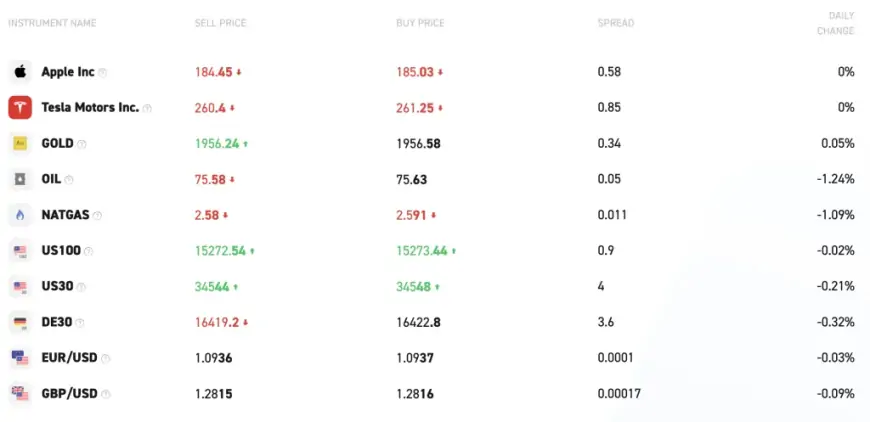

XTB charges zero commission for trading across all supported markets. However, users are required to cover the market spread.

Now that we've discussed the markets XTB supports, let's delve into the fee structure in this section of our XTB review.

Keep reading to understand the fees associated with trading and making payments.

Trading fees

Firstly, let's examine XTB's trading fees:

Commissions

XTB does not impose any commission charges for trading across all supported markets. Therefore, trades are executed based solely on the market spread.

Spreads

XTB generates revenue from the market spread, which denotes the difference between the bid (buy) and ask (sell) prices. Spreads are variable and fluctuate in accordance with market conditions.

However, XTB provides the minimum spreads for all supported markets, allowing for an evaluation of their competitiveness. For instance, major pairs like EUR/USD and GBP/USD feature a minimum spread of just 0.1 pips, which is particularly competitive considering the absence of commission charges.

Overnight financing charges (Swap fees)

Overnight financing, also known as swap fees, is another factor to take into account. This is particularly relevant as XTB specializes in CFDs, which incur charges for each day the trade remains active.

Once again, the specific overnight financing costs will vary depending on the asset being traded. These charges are also influenced by the level of leverage utilized and the overall size of the position.

Furthermore, swap fees are contingent upon whether the trader has taken a long or short position in the market. For example, while long traders incur swap fees, short-sellers receive a rebate, and vice versa.

It's worth mentioning that XTB provides an option for a swap-free account. This enables traders to maintain positions overnight without incurring swap fees. However, it's important to note that this type of account typically comes with wider spreads.

| Forex | Stocks | Indices | ETFs | Commodities | Cryptocurrencies | |

| Fee | Spread-only | Spread-only | Spread-only | Spread-only | Spread-only | Spread-only |

| Example Minimum Spread | EUR/USD: 0.1 pip | All: 0.3% spread | S&P 500: 0.5 points | Ark Fintech Innovation: 0.44% | Gold: 0.25% | Bitcoin: 0.5% |

Non-Trading charges

Having covered commissions, spreads, and overnight financing, let's delve into the non-trading fees that apply.

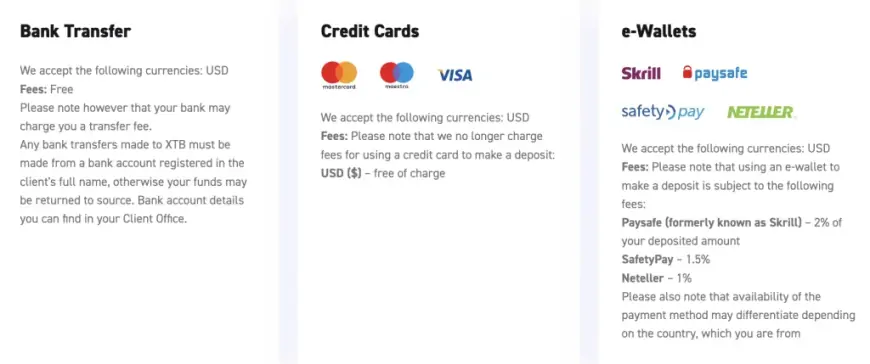

Deposits and withdrawals

Transferring funds using a debit/credit card or bank wire incurs no fees. However, e-wallet deposits are subject to a fee ranging between 1% and 2%, applicable to methods like Skrill, SafetyPay, and Neteller.

XTB does not impose withdrawal fees, except for cashouts below $50. In such cases, a $30 fee is levied.

Inactivity

XTB enforces an inactivity fee for dormant accounts, triggered after 12 months of inactivity. Subsequently, $10 is deducted monthly from the trading account.

This fee persists until the trader initiates a position or the account balance reaches zero. To avoid inactivity fees, it's advisable to withdraw the entire balance.

| Deposits | Withdrawals | Inactivity | |

| Fee | There are no fees for deposits made via debit/credit cards and bank wires. However, using e-wallets incurs a deposit fee ranging from 1% to 2%. | Withdrawals are free of charge unless the withdrawal amount is less than $50. In such cases, a $30 fee is applied. | After one year of inactivity, a fee of $10 is charged per month. |

Which trading platforms does XTB endorse?

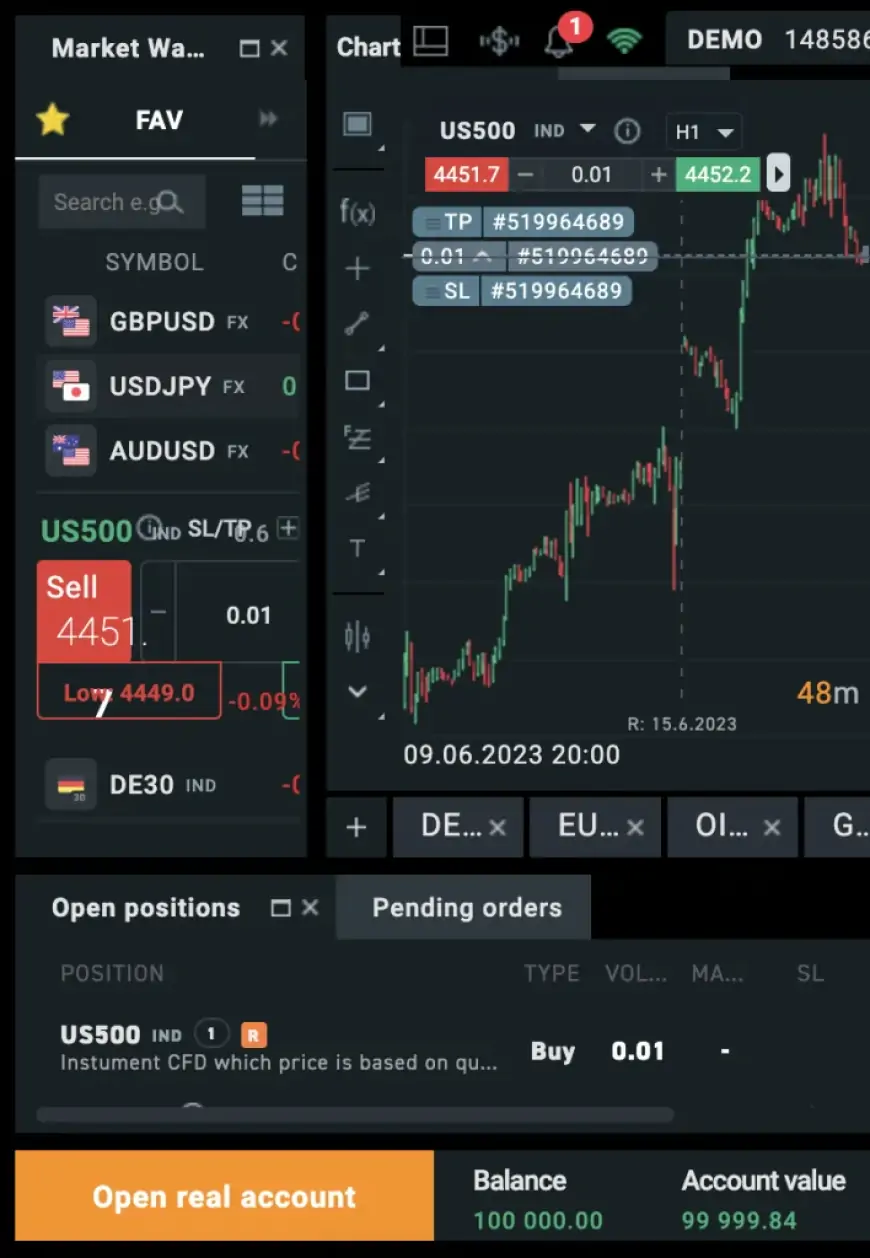

XTB provides its own proprietary trading platform, xStation5, which is available through web browsers and a top-tier investment app for iOS and Android. Additionally, xStation 5 can be installed as desktop software for both Windows and Mac operating systems. Regardless of the chosen platform, users have access to identical tools, features, and capabilities.

Our assessment revealed that xStation 5 caters to both novice and experienced traders. It offers a plethora of analysis tools, such as technical and economic indicators, as well as customizable charts. Furthermore, xStation 5 seamlessly integrates with prominent financial news websites, allowing traders to merge fundamental and technical analyses within a single platform.

We appreciate that xStation 5 offers customizable order types like limit, stop-loss, and take-profit orders. Users can choose between light and dark modes based on their preferences. However, while xStation 5 provides comprehensive trading features, XTB does not support external trading platforms like MT4 or MT5, which may disappoint users accustomed to those platforms.

XTB usability

In terms of usability, XTB provides a user-friendly experience suitable for traders of all skill levels. The account registration and KYC processes are quick, typically taking less than five minutes, and there is no minimum deposit requirement. Deposits via debit/credit cards and e-wallets are processed instantly. Once the account is funded, traders can seamlessly access the platform from their preferred device, whether it's a mobile device, web browser, or desktop software, ensuring a smooth trading experience across all options.

However, some of the analysis tools provided on xStation 5 may not be beginner-friendly, particularly technical indicators that require prior experience. To address this, XTB offers a free demo account that replicates live market conditions.

This allows users to familiarize themselves with xStation 5 and practice their trading strategies without risking real funds. The demo account comes pre-loaded with $100,000 in virtual funds.

However, some of the analysis tools provided on xStation 5 may not be beginner-friendly, particularly technical indicators that require prior experience. To address this, XTB offers a free demo account that replicates live market conditions.

This allows users to familiarize themselves with xStation 5 and practice their trading strategies without risking real funds. The demo account comes pre-loaded with $100,000 in virtual funds.

XTB's analytical tools

Regarding analysis features, XTB's native trading suite offers a comprehensive array of tools covering both technical and fundamental research. Traders have the flexibility to customize their trading screen, including chart timeframes ranging from one minute to a month.

Moreover, traders can utilize built-in chart drawing tools for trend analysis, along with a wide range of technical indicators such as the Parabolic SAR, Relative Strength Index, Simple Moving Averages, and Bollinger Bands.

On the left side of the charting screen, users can browse for their preferred markets or set up a watchlist. Beneath the charting section, there's a summary of open and pending positions. Above the charting area, users can utilize fundamental research tools, including information on upcoming economic events, market analysis, and real-time news. Additionally, xStation 5 offers built-in educational resources, making it particularly beneficial for beginners who are mastering technical analysis strategies.

Account types on XTB

XTB provides two account types for retail clients. Firstly, there's the standard account featuring commission-free trading with spreads starting from 0.1 pips on EUR/USD, and no minimum deposit is required. This is suitable for day traders and scalpers. The alternative is the swap-free account, also commission-free but with higher spreads. However, this account allows traders to hold positions overnight without swap fees, making it suitable for long-term strategies like swing trading. Moreover, there's no minimum deposit requirement for this account type. Additionally, XTB offers professional accounts for experienced traders who meet specific criteria.

To qualify, traders must meet two out of three criteria:

- Possess an investment portfolio valued at a minimum of €500,000, excluding real estate.

- Demonstrate at least one year of proven experience in the financial sector.

- Show a history of executing a minimum of 10 trades per quarter, with transactions totaling €500,000 or more, including leveraged positions.

The main advantage of a professional account is the increased leverage and trading limits it offers.

XTB app

XTB provides a proprietary app for both iOS and Android devices, offering all the features and tools available on desktop and web platforms. This is advantageous for traders who prefer to manage their positions while on the move. Additionally, xStation 5's charting tools are fully optimized for iOS and Android smartphones, ensuring users can efficiently identify trading opportunities from any location.

The XTB app includes features for setting up alerts, which notify users via push notifications when specific metrics are met, such as increased asset volatility. Additionally, users can conveniently make payments, including deposits and withdrawals, using the XTB app. Overall, the app is designed to be user-friendly and suitable for traders of all skill levels.

Payment methods supported by XTB

XTB supports a variety of payment methods to facilitate seamless deposit and withdrawal transactions. These include:

- Debit/credit cards (Visa, MasterCard, and Maestro)

- Bank Wires

- E-wallets (Skrill, Paysafe, SafetyPay, and Neteller)

While bank wires and debit/credit cards incur no fees, using Neteller, SafetyPay, or Skrill for deposits may involve fees ranging from 1% to 2%. Withdrawals exceeding $50 are processed without fees, but a $30 fee applies to withdrawals below this threshold.

Minimum account balance

XTB does not impose a minimum deposit requirement, making it attractive for novice traders starting with small amounts. However, traders should consider the platform's minimum trade requirements, which are often higher than those of other trading platforms.

For instance, trading US-listed stocks requires a minimum of $50, whereas platforms like eToro and Webull have minimums as low as $10 and $5, respectively. Minimum trade sizes for commodities on XTB are significantly higher, such as $400 for cattle and $100 for gold. Leverage can reduce these minimums substantially, but trading with high leverage entails risks. Therefore, it's essential to consider minimum trade amounts when depositing funds.

Payout times

XTB indicates that withdrawal requests are typically handled within one business day. This implies that requests made on weekends will be addressed starting from Monday at the earliest. However, initial withdrawals may experience slightly extended processing times. After processing, the time taken for transactions depends on the chosen payment method. For instance, e-wallet payments are generally instantaneous, whereas debit/credit cards and bank wires may require a few working days to complete.

Bonuses for joining XTB

Our evaluation of XTB reveals that some clients may qualify for a welcome bonus, contingent upon their country of residence.

For instance:

- Residents of the UK, European Union, and the Middle East are ineligible for a bonus due to regulatory constraints imposed by entities like the FCA, which restricts the provision of trading-related cash incentives.

- Conversely, individuals from regions outside of those mentioned above are eligible.

The XTB bonus entails a 50% increase in the initial deposit. While XTB specifies that the deposit must be a minimum of $100 to qualify, there is no maximum amount stipulated.

Furthermore, those interested in claiming the bonus must reach out to XTB directly via live chat.

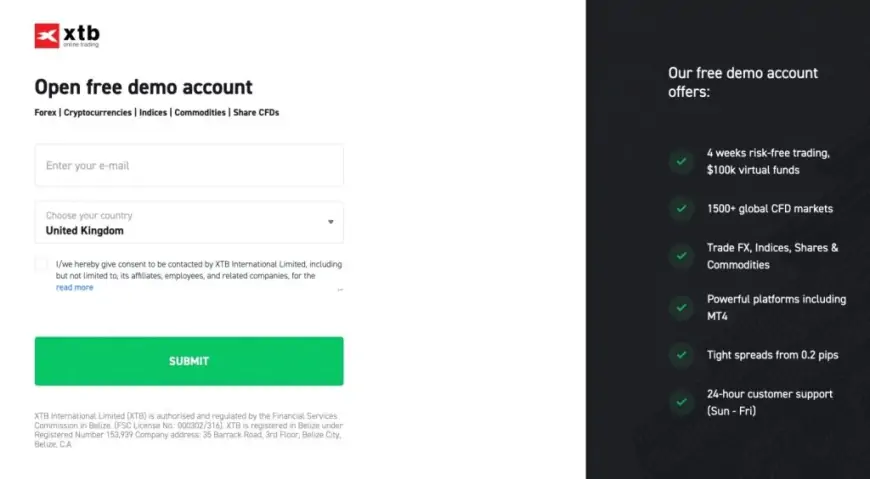

Is a demo account available with XTB?

We were glad to find that XTB provides a complimentary demo account to all users. As mentioned previously, the demo account includes $100,000 in virtual funds for paper trading. It replicates real market conditions, enabling traders to refine their strategies in a risk-free yet authentic setting.

The demo account offers unrestricted access to xStation 5 on all supported devices, allowing users ample time to evaluate the platform's suitability for their trading objectives.

It's important to mention that the XTB demo account is only accessible for a period of four weeks. Beyond this timeframe, users won't have access to it anymore. This limitation stands out as a significant drawback, particularly when compared to platforms like eToro, which offer unlimited access to their demo accounts.

However, accessing the demo platform requires users to open a basic account, which involves providing their name, email address, and country of residence. At any point, users can transition to a full XTB account by furnishing additional information.

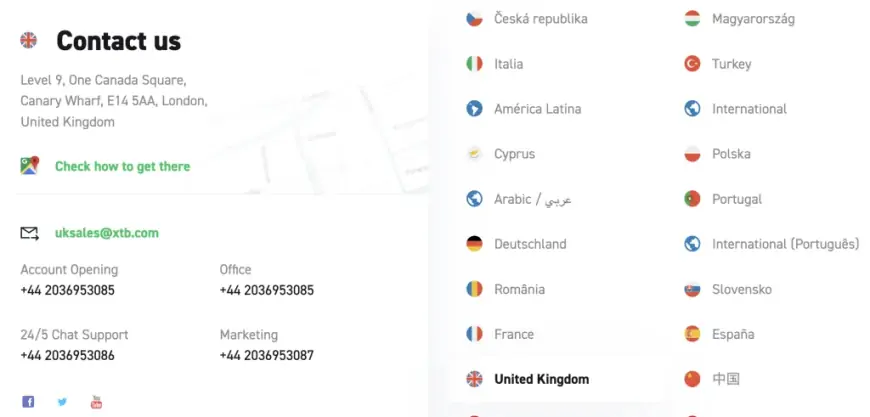

XTB customer service

XTB provides extensive support through various contact methods and languages, ensuring excellent customer service.

Their support team is available 24/5, from Sunday to Friday, allowing users to interact with agents in real-time through the convenient live chat feature.

Alternatively, XTB provides telephone support, offering over a dozen local phone numbers across Europe, Asia, and the Middle East, with assistance available in the respective local languages.

Additionally, XTB maintains a social media presence on platforms like Facebook and Twitter, offering users another avenue to reach out for support.

XTB regulatory compliance and client safety

XTB, established in 2004, is subject to regulation by multiple authorities, contributing to its strong reputation for client safety and fund management.

Central to our evaluation of XTB was its safety and reliability.

Founded almost two decades ago, XTB boasts a substantial client base exceeding 657,000 globally and is publicly traded on the Warsaw Stock Exchange with a market capitalization surpassing 4.8 billion Polish zloty (approximately $1 billion).

Presently, XTB's stock has a market capitalization exceeding 4.8 billion Polish zloty equivalent to approximately $1 billion.

Regarding regulatory compliance, XTB holds licenses from multiple financial entities, comprising:

- The UK’s Financial Conduct Authority (FCA)

- Financial Services Commission in Belize

- The Cyprus Securities and Exchange Commission (CySEC)

- The Comisión Nacional del Mercado de Valores in Spain.

- Komisja Nadzoru Finansowego (KNF) in Poland

The regulatory jurisdiction applicable to users depends on their country of residence. For instance, within the European Union, excluding Poland and Spain, clients are regulated by CySEC. Conversely, individuals outside the UK and Europe are overseen by the Financial Services Commission in Belize.

Regardless of the regulatory authority, XTB segregates client funds, maintaining them in separate bank accounts. This practice ensures that in the unlikely event of XTB encountering financial difficulties, client fund protections may apply, subject to eligibility and maximum amounts as determined by the regulatory body.

For instance, in the UK, clients are covered by the Financial Services Compensation Scheme (FSCS), safeguarding accounts up to £85,000 in the event of insolvency. However, those under the jurisdiction of Belize are not entitled to compensation.

Overall, XTB is considered a secure and trustworthy trading platform. With nearly two decades of operational experience, it holds legal authorization to operate in all serviced countries.

Moreover, XTB demonstrates a commitment to compliance with anti-money laundering regulations. Therefore, all registered users are required to undergo a Know Your Customer (KYC) process, necessitating a government-issued ID matching the account details.

What countries does XTB serve?

XTB is an international trading platform that welcomes clients from most countries worldwide.

Except for the following jurisdictions:

| Ineligible countries |

| Afghanistan |

| Albania |

| Australia |

| Belgium |

| Bangladesh |

| Belize |

| Bosnia and Herzegovina |

| Cuba |

| Ethiopia |

| Guyana |

| Hong Kong |

| India |

| Indonesia |

| Iran |

| Israel |

| Iraq |

| Japan |

| Kenya |

| Laos |

| Libya |

| Macao |

| Mauritius |

| Mozambique |

| North Korea |

| New Zealand |

| Palestine |

| Pakistan |

| Panama |

| Republic of Zimbabwe |

| Republic of the Congo |

| South Korea |

| Singapore |

| Syria |

| Turkey |

| Uganda |

| United States |

| Vanuatu |

| Venezuela |

| Yemen |

How can I learn to use XTB effectively?

In this part of our XTB review, we outline the setup procedure, covering account creation, depositing funds, and executing a trade.

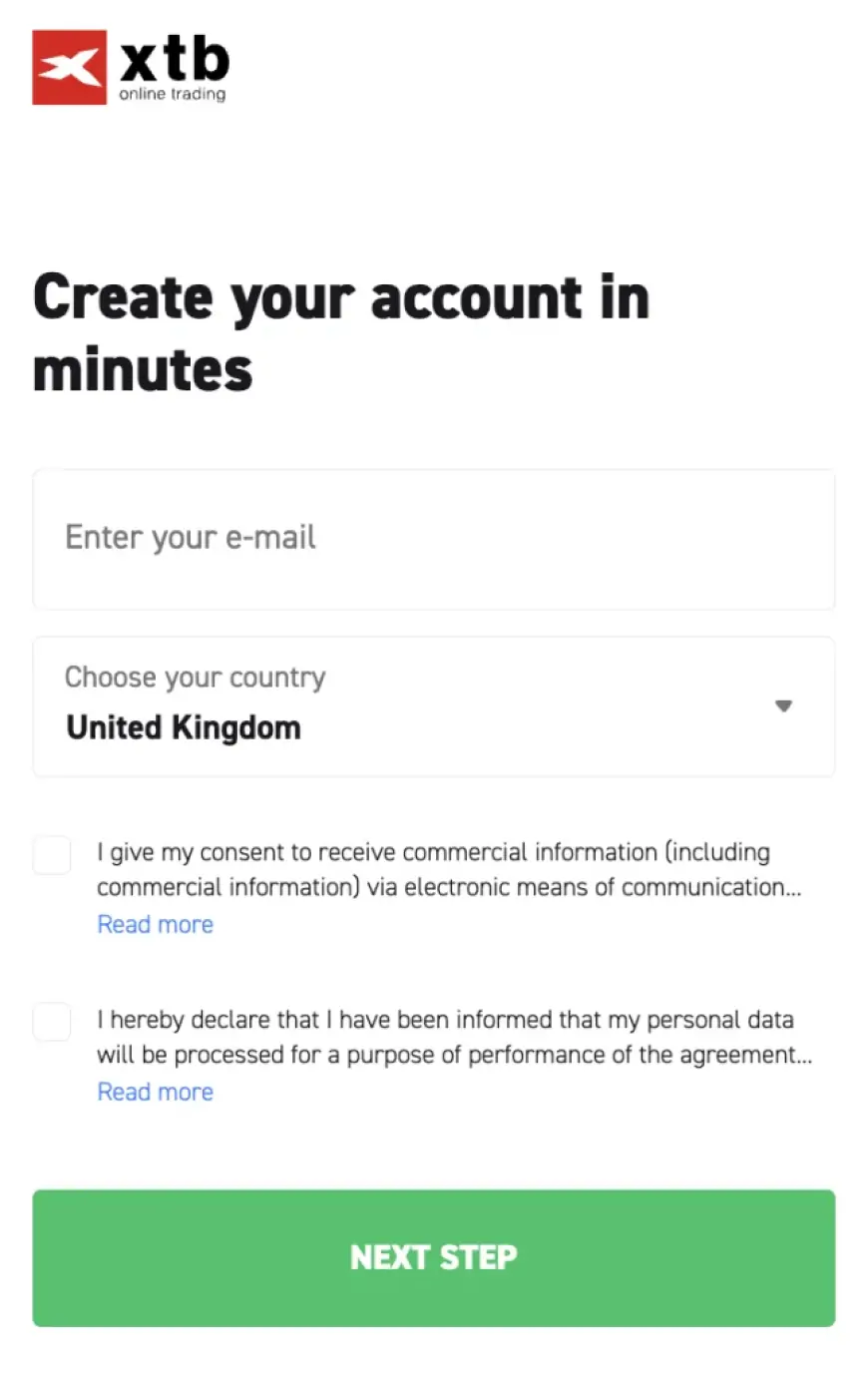

1. Register for an XTB account

To begin, click on the 'Create Account' button and enter your email address.

Select your country of residence and click on ‘Next Step’.

Then, create a strong password. XTB will prompt you to provide some personal details, including your full name, phone number, and date of birth.

2. Complete the KYC process

As a regulated platform, XTB requires users to undergo a quick Know Your Customer (KYC) process.

You'll need to provide two documents:

- A government-issued ID, such as a passport, driver’s license, or national ID card.

- Proof of address, which can be in the form of bank statements, tax documents, or utility bills.

XTB will verify these documents to remove any account restrictions.

3. Make a deposit

Before you can start trading with real funds, you'll need to deposit money into your account.

There is no mandatory minimum deposit, and XTB accepts various payment methods, including debit/credit cards, e-wallets, and bank wires.

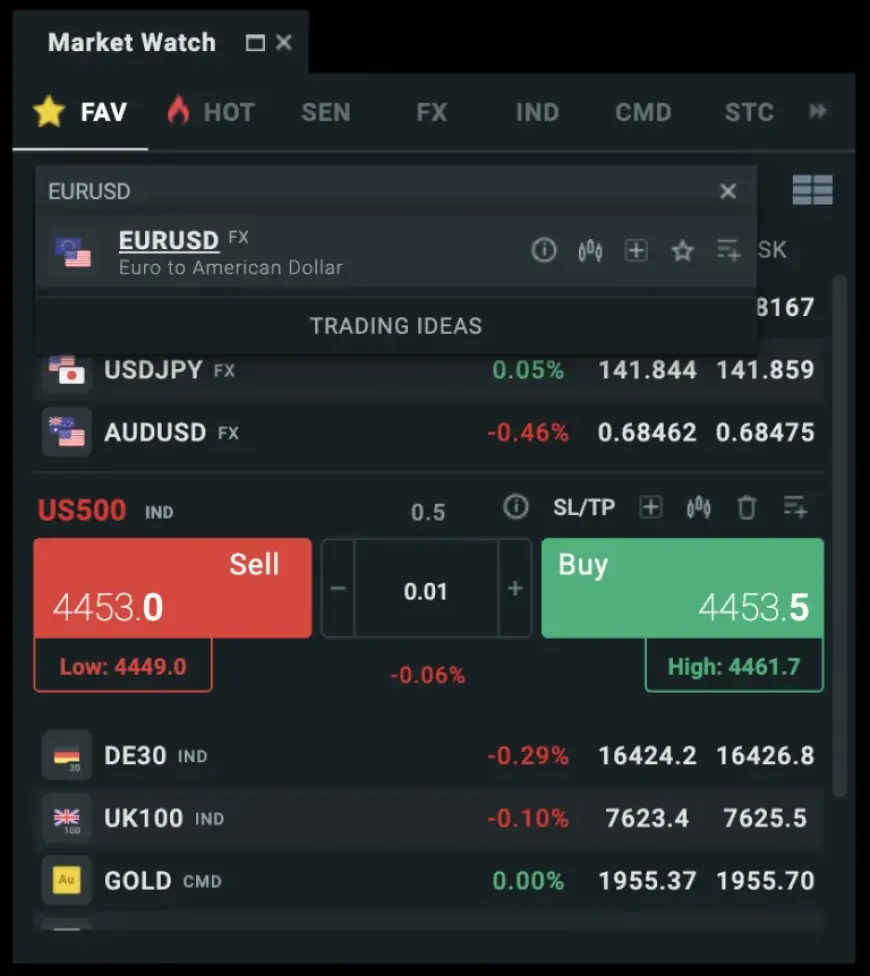

4. Search for a Trading Market

Once your XTB account is funded, it's time to explore the available trading options.

Access xStation 5 on your preferred device, whether it's a smartphone, desktop, or web browser. For this demonstration, we'll use the browser version of xStation 5.

On the left-hand side of the screen, locate the search box and enter the desired asset, such as 'EURUSD'. Then, click on the 'Candlestick' icon to load the complete chart.

5. Execute a trade

The last step is to initiate a trading order.

For an immediate trade at the next available price, opt for either 'Buy' or 'Sell'. This action will open a long or short position, respectively. When selecting this option, users must manually close their trade.

However, many traders prefer to customize their orders. For instance, XTB facilitates limit orders, enabling users to specify the price at which the order gets executed. These orders remain pending until the market reaches the desired price.

Moreover, XTB permits the implementation of stop-loss and/or take-profit orders. This eliminates the necessity for manual closure of orders. Instead, XTB automatically closes the position when either the stop-loss or take-profit price is reached.