What is Forward Price to Earnings? The ultimate guide

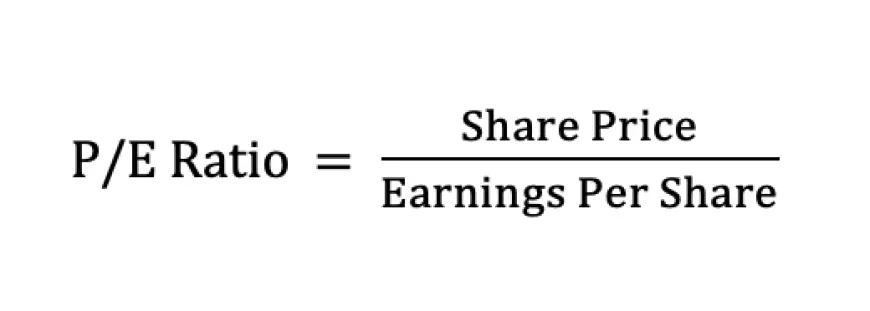

Forward Price to Earnings (Forward P/E) is a financial metric indicating a company's projected earnings per share relative to its stock price.

Understanding Forward Price to Earnings

Forward price-to-earnings (forward P/E) is a variation of the price-to-earnings (P/E) ratio, incorporating predicted earnings for the calculation. Although the earnings in this method are estimations and less dependable than present or past earnings, there are advantages to using estimated P/E for analysis.

The anticipated earnings employed in the following equation typically represent either the forecasted earnings for the subsequent 12 months or the upcoming full-year fiscal (FY) period. The forward P/E ratio is often compared to the trailing P/E ratio.

For instance, consider a company with a present share price of $50 and earnings per share of $5 for the current year. Analysts predict a 10% growth in the company's earnings over the next fiscal year. The current P/E ratio is calculated as $50 / 5 = 10x.

In contrast, the forward P/E would be $50 / (5 x 1.10) = 9.1x. It's worth noting that the forward P/E is lower than the current P/E because it considers future earnings growth in relation to the current share price.

Understanding the significance of Forward Price-to-Earnings

Analysts often liken the P/E ratio to a price tag attached to earnings, providing a way to gauge a company's earning potential relative to its market value. In an ideal scenario, $1 of earnings at one company should hold the same value as $1 of earnings at another. However, disparities in stock prices often exist, leading to varied interpretations.

Consider two companies, A and B, where A trades at $5 and B at $10 per share. This discrepancy suggests that the market values B's earnings more. The reasons behind this valuation difference could range from B's earnings being overvalued to B deserving a premium due to superior management and a stronger business model.

When calculating the trailing P/E ratio, analysts assess today's price against earnings from the past 12 months or fiscal year, relying on historical data. Conversely, forward P/E utilizes earnings estimates to predict a company's relative value based on future earnings. For instance, if company B's current price is $10 with projected earnings doubling to $2 next year, the forward P/E ratio would be 5x, indicating a favorable outlook on earnings growth.

Comparing the forward P/E to the current P/E ratio offers insights into analysts' expectations. A lower forward P/E suggests anticipated earnings growth, while a higher ratio indicates expectations of declining earnings.

Limitations of Forward P/E

The limitations of forward P/E stem from its reliance on estimated future earnings, introducing potential inaccuracies and biases. Companies may manipulate earnings forecasts to meet or beat consensus estimates, leading to misleading forward P/E ratios. Additionally, discrepancies can arise between company-provided estimates and those from external analysts, adding complexity and uncertainty.

Investors relying solely on forward P/E for investment decisions should conduct thorough research. Changes in earnings guidance can significantly impact forward P/E ratios, necessitating constant reassessment. To mitigate these issues, combining both forward and trailing P/E metrics can provide a more comprehensive and reliable assessment of a company's valuation and growth prospects.

Forward P/E vs Trailing P/E

Forward P/E and trailing P/E are two key metrics used in financial analysis, but they differ in their approach and implications.

Forward P/E, as the name suggests, incorporates projected earnings per share (EPS) into its calculation. It offers a glimpse into future earnings potential and is based on analysts' forecasts. On the other hand, trailing P/E relies on historical performance, dividing the current share price by the total EPS earnings over the past 12 months. Trailing P/E is widely favored for its objectivity, assuming accurate reporting of earnings by the company.

Many investors prefer trailing P/E because it relies on concrete past data rather than speculative projections. However, this metric has drawbacks. Past performance doesn't guarantee future results, so investing solely based on historical earnings may not capture a company's true potential. Additionally, trailing P/E can be less responsive to sudden changes in stock prices driven by significant events, as the EPS number remains constant.

In essence, while trailing P/E provides a solid historical perspective, forward P/E offers insights into future earnings growth potential, allowing investors to make more informed decisions about a company's valuation and investment prospects.

Calculating Forward Price-to-Earnings (Forward P/E) in Excel

You can use Microsoft Excel to compute a company's forward P/E for the upcoming fiscal year. The formula for forward P/E is straightforward: divide the company's market price per share by its projected earnings per share. Start by adjusting the column widths in Excel. Right-click on columns A, B, and C, then select "Column Width" and set the value.

To compare the forward P/E ratios of two companies in the same industry, follow these steps:

- In cell B1, enter the name of the first company, and in C1, enter the name of the second company.

- Input "Market price per share" in cell A2, and fill in the respective market prices per share for both companies in cells B2 and C2.

- Enter "Forward earnings per share" in cell A3, and input the expected EPS for the next fiscal year for each company in cells B3 and C3.

- Type "Forward price to earnings ratio" in cell A4.

For instance, suppose company ABC trades at $50 with an expected EPS of $2.60. Input "Company ABC" in cell B1, and then enter "=50" in cell B2 and "=2.6" in cell B3. Use the formula "=B2/B3" in cell B4 to find the forward P/E ratio for company ABC, which would be 19.23 in this case.

Similarly, if company DEF has a market price per share of $30 and an expected EPS of $1.80, enter "Company DEF" in cell C1. Then, input "=30" in cell C2 and "=1.80" in cell C3. Use the formula "=C2/C3" in cell C4 to calculate the forward P/E for company DEF, which would be 16.67.